Integrated Risk Management Commitment

In order to realize the Company’s Vision and Mission, as well as to ensure the achievement of Value Creation and Protection for all stakeholders, PT PLN Indonesia Power is strongly committed to implementing Integrated Risk Management.

Integrated Risk Management is increasingly vital in navigating future challenges and seizing emerging opportunities. These dynamics must be addressed precisely, accurately, and with careful consideration, based on reliable Governance, Risk, and Compliance (GRC) practices.

To guide the effective implementation of Integrated Risk Management across the organization, the Company has established Board of Directors Regulation Number 0027.P/DIR/2024 concerning the Strategic Policy on Integrated Risk Management at PT PLN Indonesia Power.

Scope of the Strategic Risk Management Policy

The key components covered in the Strategic Policy include:

- Risk Management Implementation;

- Risk Management Principles;

- Integrated Risk Management Organizational Structure;

- Risk Governance;

- Risk Management Policy;

- Risk Management Process;

- Risk Reporting.

The Integrated Risk Management Process is carried out by all levels of the organization, encompassing the planning, implementation, monitoring, and evaluation of risk management within each business process, and integrated with other management systems.

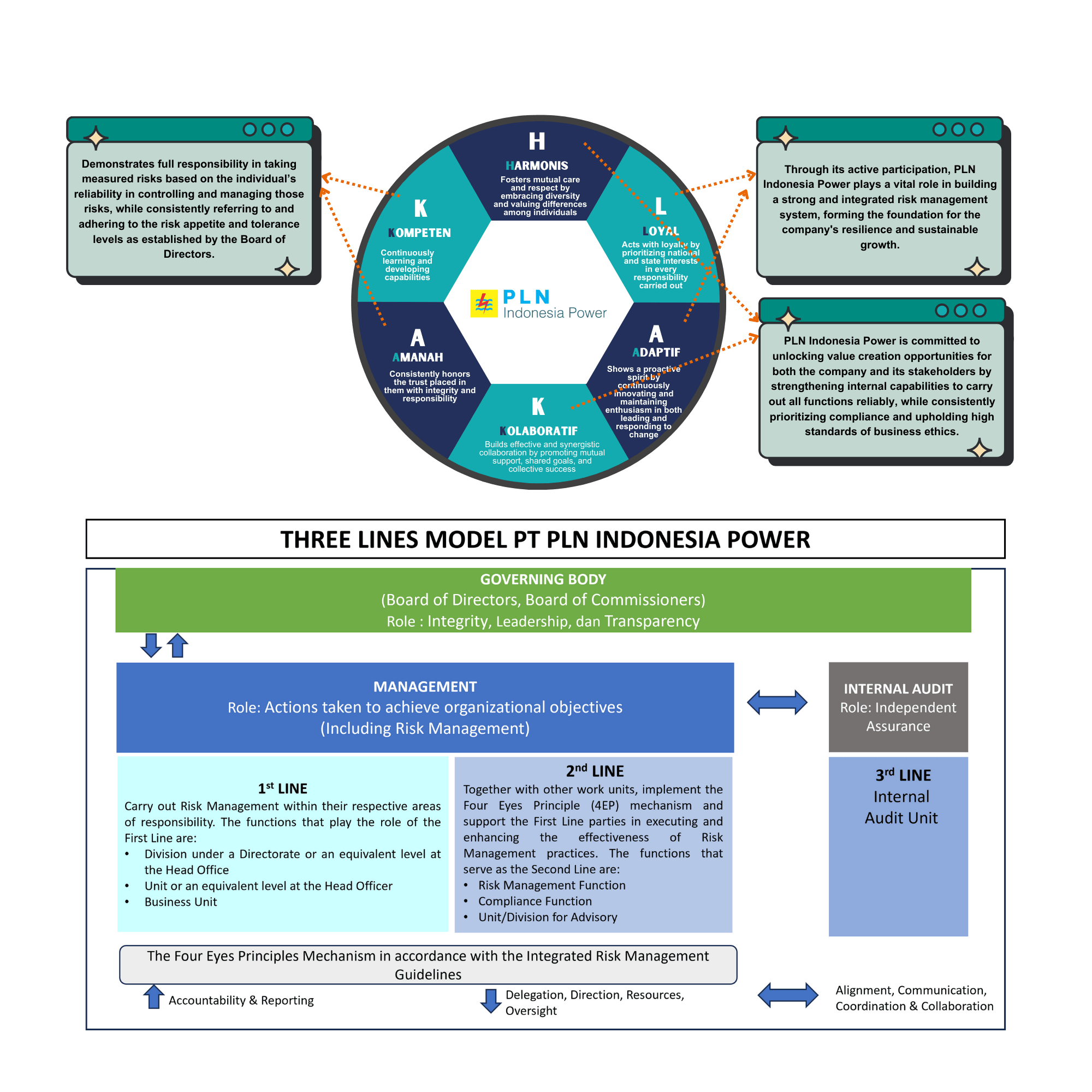

PT PLN Indonesia Power adopts the Three Lines Model and applies the Four Eyes Principle (4EP) as part of its strategic decision-making process in managing risks across the enterprise.

To uphold the Risk Management Core Values, which serve as a behavioral foundation for all personnel in establishing sound risk management practices, the Company also refers to Board of Directors Regulation Number 0073.P/DIR/2023 regarding the General Policy for the Implementation of Integrated Governance, Risk, and Compliance (GRC).

These core values of risk management are derived from the Company’s AKHLAK values (Amanah, Competent, Harmonious, Loyal, Adaptive, and Collaborative), and are reflected in the 18 Behavioral Guidelines that shape the actions of every PLN Indonesia Power employee in carrying out their duties and responsibilities, while supporting business and operational excellence.