Page 305 - Annual Report 2022 - PLN Indonesia Power

P. 305

Analisis dan Pembahasan Manajemen

Management Discussion and Analysis

Perbandingan antara Target 2022, Realisasi 2022 dan Proyeksi 2023

Comparison between 2022 Target, 2022 Realization, and 2023 Projection

Realisasi Jumlah Liabilitas tahun 2022 sebesar Rp19,71 triliun Realized Total Liabilities in 2022 was Rp19.71 trillion, or 78.15%

dengan pencapaian 78,15% dari target RKAP 2022. Pencapaian ini of the WP&B 2022 target. This was particularly supported by

terutama disebabkan pencairan pinjaman SHL ECA dan KFW belum the payments of ECA SHL and lease liabilities. Further for 2023,

sepenuhnya terealisasi. Selanjutnya, pada tahun 2023, Jumlah Total Liabilities is projected at Rp41.55 trillion, with the basis of

Liabilitas diproyeksikan sebesar Rp41,55 triliun dengan dasar asumsi assumption that Non-Current Liabilities will increase 211% from

Liabilitas jangka panjang meningkat sebesar 211% dari realisasi the unaudited realization of 2022, which is predominantly due

audited 2022 dominan disebabkan oleh kenaikan beban pajak to the increase in deferred tax expenses and employee benefit

tangguhan dan beban manfaat pekerja (PSAK 24). Liabilitas jangka expenses (PSAK 24). Current Liabilities will increase 171% from the

pendek naik sebesar 171% dari realisasi audited 2022 disebabkan unaudited realization of 2022, due to the increase in primary energy

karena naiknya hutang pengadaan energi primer. Selain itu juga procurement payables. Another determining factor was the transfer

dikarenakan pengalihan liabilitas dari unit-unit sub-holding dari PLN of liabilities from subholding units from PLN to PLN Indonesia

ke PLN Indonesia Power. Power.

Realisasi Jumlah Ekuitas tahun 2022 sebesar Rp192,11 triliun dengan Realized Total Equity in 2022 was Rp192.11 trillion, or 102.85%

pencapaian 102,85% dari target RKAP 2022. Pencapaian ini terutama of the WP&B 2022 target. This was mainly due to the increase in

didukung oleh laba tahun berjalan meskipun terdapat pengurangan income for the year, albeit a reduction in dividend 2019 recognition

atas pengakuan dividen 2021 sebagai pengurang saldo laba. as reduction of retained earnings. Further for 2023, Total Equity is

Selanjutnya, pada tahun 2023, Jumlah Ekuitas diproyeksikan sebesar projected at Rp372.23 trillion, with the basis of assumption that the

Rp372,23 triliun dengan dasar asumsi Laba tahun 2022 disetor Income for 2022 will be deposited as dividend, and therefore the

sebagai dividen sehingga ekuitas tahun 2023 identik dengan realisasi equity in 2023 will be identical with that of the unaudited realization

audited 2022. Selain itu juga terdapat tambahan modal dari unit-unit of 2021. There was also additional capital from subholding units

sub-holding dari PLN ke PLN Indonesia Power sebesar Rp175,9 triliun. from PLN to PLN Indonesia Power amounting to Rp175.9 trillion.

Target, Realisasi, dan Proyeksi Laba Rugi

Profit/Loss Target, Realization, and Projection

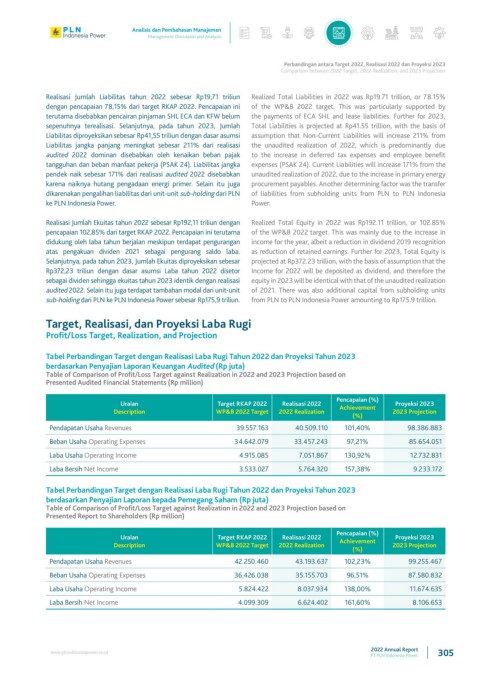

Tabel Perbandingan Target dengan Realisasi Laba Rugi Tahun 2022 dan Proyeksi Tahun 2023

berdasarkan Penyajian Laporan Keuangan Audited (Rp juta)

Table of Comparison of Profit/Loss Target against Realization in 2022 and 2023 Projection based on

Presented Audited Financial Statements (Rp million)

Pencapaian (%)

Uraian Target RKAP 2022 Realisasi 2022 Proyeksi 2023

Description WP&B 2022 Target 2022 Realization Achievement 2023 Projection

(%)

Pendapatan Usaha Revenues 39.557.163 40.509.110 101,40% 98.386.883

Beban Usaha Operating Expenses 34.642.079 33.457.243 97,21% 85.654.051

Laba Usaha Operating Income 4.915.085 7.051.867 130,92% 12.732.831

Laba Bersih Net Income 3.533.027 5.764.320 157,38% 9.233.172

Tabel Perbandingan Target dengan Realisasi Laba Rugi Tahun 2022 dan Proyeksi Tahun 2023

berdasarkan Penyajian Laporan kepada Pemegang Saham (Rp juta)

Table of Comparison of Profit/Loss Target against Realization in 2022 and 2023 Projection based on

Presented Report to Shareholders (Rp million)

Pencapaian (%)

Uraian Target RKAP 2022 Realisasi 2022 Proyeksi 2023

Description WP&B 2022 Target 2022 Realization Achievement 2023 Projection

(%)

Pendapatan Usaha Revenues 42.250.460 43.193.637 102,23% 99.255.467

Beban Usaha Operating Expenses 36.426.038 35.155.703 96,51% 87.580.832

Laba Usaha Operating Income 5.824.422 8.037.934 138,00% 11.674.635

Laba Bersih Net Income 4.099.309 6.624.402 161,60% 8.106.653

2022 Annual Report

www.plnindonesiapower.co.id 305

PT PLN Indonesia Power