Page 304 - Annual Report 2022 - PLN Indonesia Power

P. 304

Powering Sustainable

and Prosperous Future

Perbandingan antara Target 2022, Realisasi 2022 dan Proyeksi 2023

Comparison between 2022 Target, 2022 Realization, and 2023 Projection

Target, Realisasi, dan Proyeksi Posisi Keuangan

Financial Position Target, Realization, and Projection

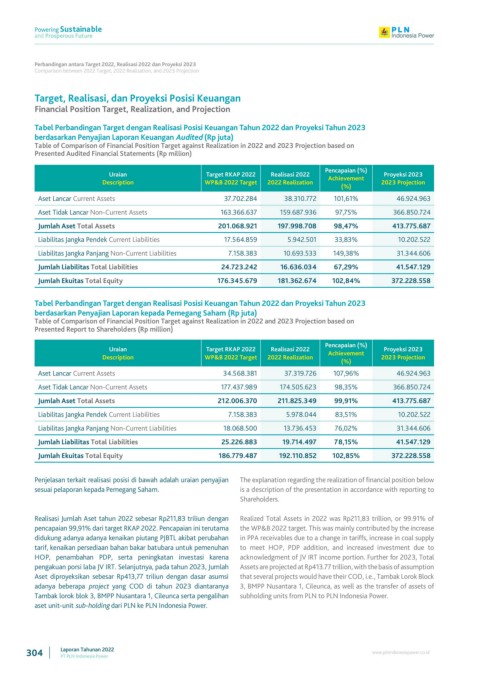

Tabel Perbandingan Target dengan Realisasi Posisi Keuangan Tahun 2022 dan Proyeksi Tahun 2023

berdasarkan Penyajian Laporan Keuangan Audited (Rp juta)

Table of Comparison of Financial Position Target against Realization in 2022 and 2023 Projection based on

Presented Audited Financial Statements (Rp million)

Pencapaian (%)

Uraian Target RKAP 2022 Realisasi 2022 Proyeksi 2023

Description WP&B 2022 Target 2022 Realization Achievement 2023 Projection

(%)

Aset Lancar Current Assets 37.702.284 38.310.772 101,61% 46.924.963

Aset Tidak Lancar Non-Current Assets 163.366.637 159.687.936 97,75% 366.850.724

Jumlah Aset Total Assets 201.068.921 197.998.708 98,47% 413.775.687

Liabilitas Jangka Pendek Current Liabilities 17.564.859 5.942.501 33,83% 10.202.522

Liabilitas Jangka Panjang Non-Current Liabilities 7.158.383 10.693.533 149,38% 31.344.606

Jumlah Liabilitas Total Liabilities 24.723.242 16.636.034 67,29% 41.547.129

Jumlah Ekuitas Total Equity 176.345.679 181.362.674 102,84% 372.228.558

Tabel Perbandingan Target dengan Realisasi Posisi Keuangan Tahun 2022 dan Proyeksi Tahun 2023

berdasarkan Penyajian Laporan kepada Pemegang Saham (Rp juta)

Table of Comparison of Financial Position Target against Realization in 2022 and 2023 Projection based on

Presented Report to Shareholders (Rp million)

Pencapaian (%)

Uraian Target RKAP 2022 Realisasi 2022 Proyeksi 2023

Description WP&B 2022 Target 2022 Realization Achievement 2023 Projection

(%)

Aset Lancar Current Assets 34.568.381 37.319.726 107,96% 46.924.963

Aset Tidak Lancar Non-Current Assets 177.437.989 174.505.623 98,35% 366.850.724

Jumlah Aset Total Assets 212.006.370 211.825.349 99,91% 413.775.687

Liabilitas Jangka Pendek Current Liabilities 7.158.383 5.978.044 83,51% 10.202.522

Liabilitas Jangka Panjang Non-Current Liabilities 18.068.500 13.736.453 76,02% 31.344.606

Jumlah Liabilitas Total Liabilities 25.226.883 19.714.497 78,15% 41.547.129

Jumlah Ekuitas Total Equity 186.779.487 192.110.852 102,85% 372.228.558

Penjelasan terkait realisasi posisi di bawah adalah uraian penyajian The explanation regarding the realization of financial position below

sesuai pelaporan kepada Pemegang Saham. is a description of the presentation in accordance with reporting to

Shareholders.

Realisasi Jumlah Aset tahun 2022 sebesar Rp211,83 triliun dengan Realized Total Assets in 2022 was Rp211,83 trillion, or 99.91% of

pencapaian 99,91% dari target RKAP 2022. Pencapaian ini terutama the WP&B 2022 target. This was mainly contributed by the increase

didukung adanya adanya kenaikan piutang PJBTL akibat perubahan in PPA receivables due to a change in tariffs, increase in coal supply

tarif, kenaikan persediaan bahan bakar batubara untuk pemenuhan to meet HOP, PDP addition, and increased investment due to

HOP, penambahan PDP, serta peningkatan investasi karena acknowledgment of JV IRT income portion. Further for 2023, Total

pengakuan porsi laba JV IRT. Selanjutnya, pada tahun 2023, Jumlah Assets are projected at Rp413.77 trillion, with the basis of assumption

Aset diproyeksikan sebesar Rp413,77 triliun dengan dasar asumsi that several projects would have their COD, i.e., Tambak Lorok Block

adanya beberapa project yang COD di tahun 2023 diantaranya 3, BMPP Nusantara 1, Cileunca, as well as the transfer of assets of

Tambak lorok blok 3, BMPP Nusantara 1, Cileunca serta pengalihan subholding units from PLN to PLN Indonesia Power.

aset unit-unit sub-holding dari PLN ke PLN Indonesia Power.

304 Laporan Tahunan 2022 www.plnindonesiapower.co.id

PT PLN Indonesia Power