Page 680 - Annual Report 2022 - PLN Indonesia Power

P. 680

Powering Sustainable

and Prosperous Future

PT INDONESIA POWER DAN ENTITAS ANAKNYA/AND ITS SUBSIDIARIES

Lampiran 5/81 Schedule

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE CONSOLIDATED

KONSOLIDASIAN FINANCIAL STATEMENTS

31 DESEMBER 2022 DAN 2021 31 DECEMBER 2022 AND 2021

(Dinyatakan dalam jutaan Rupiah, kecuali dinyatakan lain) (Expressed in millions of Rupiah, unless otherwise stated)

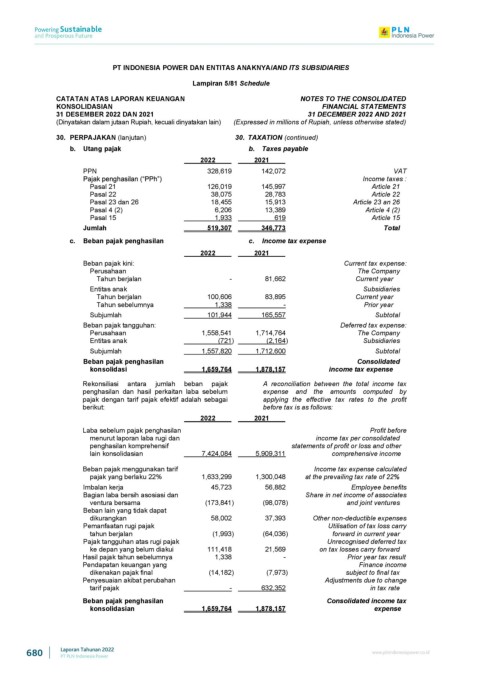

30. PERPAJAKAN (lanjutan) 30. TAXATION (continued)

b. Utang pajak b. Taxes payable

2022 2021

PPN 328,619 142,072 VAT

Income taxes :

Pasal 21 126,019 145,997 Article 21

Pasal 22 38,075 28,783 Article 22

Pasal 23 dan 26 18,455 15,913 Article 23 an 26

Pasal 4 (2) 6,206 13,389 Article 4 (2)

Pasal 15 1,933 619 Article 15

Jumlah 519,307 346,773 Total

c. Beban pajak penghasilan c. Income tax expense

2022 2021

Beban pajak kini: Current tax expense:

Perusahaan The Company

Tahun berjalan - 81,662 Current year

Entitas anak Subsidiaries

Tahun berjalan 100,606 83,895 Current year

Tahun sebelumnya 1,338 - Prior year

Subjumlah 101,944 165,557 Subtotal

Beban pajak tangguhan: Deferred tax expense:

Perusahaan 1,558,541 1,714,764 The Company

Entitas anak (721) (2,164) Subsidiaries

Subjumlah 1,557,820 1,712,600 Subtotal

Beban pajak penghasilan Consolidated

konsolidasi 1,659,764 1,878,157 income tax expense

Rekonsiliasi antara jumlah beban pajak A reconciliation between the total income tax

penghasilan dan hasil perkaitan laba sebelum expense and the amounts computed by

pajak dengan tarif pajak efektif adalah sebagai applying the effective tax rates to the profit

berikut: before tax is as follows:

2022 2021

Laba sebelum pajak penghasilan Profit before

menurut laporan laba rugi dan income tax per consolidated

penghasilan komprehensif statements of profit or loss and other

lain konsolidasian 7,424,084 5,909,311 comprehensive income

Beban pajak menggunakan tarif Income tax expense calculated

pajak yang berlaku 22% 1,633,299 1,300,048 at the prevailing tax rate of 22%

Imbalan kerja 45,723 56,882 Employee benefits

Bagian laba bersih asosiasi dan Share in net income of associates

ventura bersama (173,841) (98,078) and joint ventures

Beban lain yang tidak dapat

dikurangkan 58,002 37,393 Other non-deductible expenses

Pemanfaatan rugi pajak Utilisation of tax loss carry

tahun berjalan (1,993) (64,036) forward in current year

Pajak tangguhan atas rugi pajak Unrecognised deferred tax

ke depan yang belum diakui 111,418 21,569 on tax losses carry forward

Hasil pajak tahun sebelumnya 1,338 - Prior year tax result

Pendapatan keuangan yang Finance income

dikenakan pajak final (14,182) (7,973) subject to final tax

Penyesuaian akibat perubahan Adjustments due to change

tarif pajak - 632,352 in tax rate

Beban pajak penghasilan Consolidated income tax

konsolidasian 1,659,764 1,878,157 expense

680 Laporan Tahunan 2022 www.plnindonesiapower.co.id

PT PLN Indonesia Power