Page 683 - Annual Report 2022 - PLN Indonesia Power

P. 683

Laporan Keuangan Audited 2022

Audited Financial Statement 2022

PT INDONESIA POWER DAN ENTITAS ANAKNYA/AND ITS SUBSIDIARIES

Lampiran 5/84 Schedule

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE CONSOLIDATED

KONSOLIDASIAN FINANCIAL STATEMENTS

31 DESEMBER 2022 DAN 2021 31 DECEMBER 2022 AND 2021

(Dinyatakan dalam jutaan Rupiah, kecuali dinyatakan lain) (Expressed in millions of Rupiah, unless otherwise stated)

30. PAJAK PENGHASILAN (lanjutan) 30. INCOME TAX (continued)

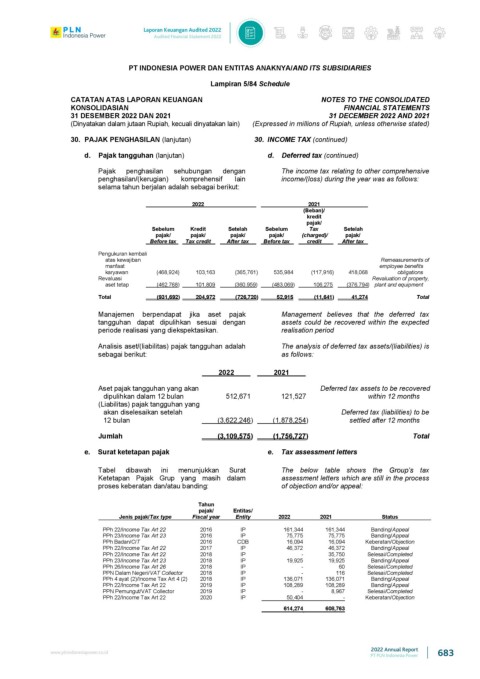

d. Pajak tangguhan (lanjutan) d. Deferred tax (continued)

Pajak penghasilan sehubungan dengan The income tax relating to other comprehensive

penghasilan/(kerugian) komprehensif lain income/(loss) during the year was as follows:

selama tahun berjalan adalah sebagai berikut:

2022 2021

(Beban)/

kredit

pajak/

Sebelum Kredit Setelah Sebelum Tax Setelah

pajak/ pajak/ pajak/ pajak/ (charged)/ pajak/

Before tax Tax credit After tax Before tax credit After tax

Pengukuran kembali

atas kewajiban Remeasurements of

manfaat employee benefits

karyawan (468,924) 103,163 (365,761) 535,984 (117,916) 418,068 obligations

Revaluasi Revaluation of property,

aset tetap (462,768) 101,809 (360,959) (483,069) 106,275 (376,794) plant and equipment

Total (931,692) 204,972 (726,720) 52,915 (11,641) 41,274 Total

Manajemen berpendapat jika aset pajak Management believes that the deferred tax

tangguhan dapat dipulihkan sesuai dengan assets could be recovered within the expected

periode realisasi yang diekspektasikan. realisation period

Analisis aset/(liabilitas) pajak tangguhan adalah The analysis of deferred tax assets/(liabilities) is

sebagai berikut: as follows:

2022 2021

Aset pajak tangguhan yang akan Deferred tax assets to be recovered

dipulihkan dalam 12 bulan 512,671 121,527 within 12 months

(Liabilitas) pajak tangguhan yang

akan diselesaikan setelah Deferred tax (liabilities) to be

12 bulan (3,622,246) (1,878,254) settled after 12 months

Jumlah (3,109,575) (1,756,727) Total

e. Surat ketetapan pajak e. Tax assessment letters

Tabel dibawah ini menunjukkan Surat The below table shows the tax

Ketetapan Pajak Grup yang masih dalam assessment letters which are still in the process

proses keberatan dan/atau banding: of objection and/or appeal:

Tahun

pajak/ Entitas/

Jenis pajak/Tax type Fiscal year Entity 2022 2021 Status

PPh 22/Income Tax Art 22 2016 IP 161,344 161,344 Banding/Appeal

PPh 23/Income Tax Art 23 2016 IP 75,775 75,775 Banding/Appeal

PPh Badan/CIT 2016 CDB 16,094 16,094 Keberatan/Objection

PPh 22/Income Tax Art 22 2017 IP 46,372 46,372 Banding/Appeal

PPh 22/Income Tax Art 22 2018 IP - 35,750 Selesai/Completed

PPh 23/Income Tax Art 23 2018 IP 19,925 19,925 Banding/Appeal

PPh 26/Income Tax Art 26 2018 IP - 60 Selesai/Completed

PPN Dalam Negeri/VAT Collector 2018 IP - 116 Selesai/Completed

PPh 4 ayat (2)/Income Tax Art 4 (2) 2018 IP 136,071 136,071 Banding/Appeal

PPh 22/Income Tax Art 22 2019 IP 108,289 108,289 Banding/Appeal

PPN Pemungut/VAT Collector 2019 IP - 8,967 Selesai/Completed

PPh 22/Income Tax Art 22 2020 IP 50,404 - Keberatan/Objection

614,274 608,763

www.plnindonesiapower.co.id 2022 Annual Report 683

PT PLN Indonesia Power