Page 682 - Annual Report 2022 - PLN Indonesia Power

P. 682

Powering Sustainable

and Prosperous Future

PT INDONESIA POWER DAN ENTITAS ANAKNYA/AND ITS SUBSIDIARIES

Lampiran 5/83 Schedule

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE CONSOLIDATED

KONSOLIDASIAN FINANCIAL STATEMENTS

31 DESEMBER 2022 DAN 2021 31 DECEMBER 2022 AND 2021

(Dinyatakan dalam jutaan Rupiah, kecuali dinyatakan lain) (Expressed in millions of Rupiah, unless otherwise stated)

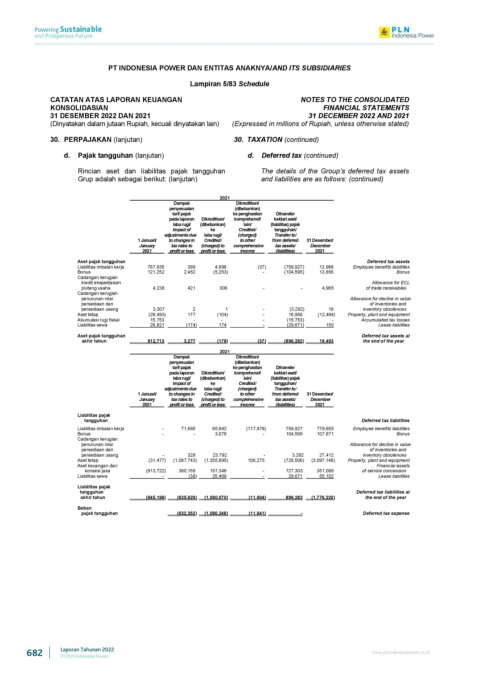

30. PERPAJAKAN (lanjutan) 30. TAXATION (continued)

d. Pajak tangguhan (lanjutan) d. Deferred tax (continued)

Rincian aset dan liabilitas pajak tangguhan The details of the Group deferred tax assets

Grup adalah sebagai berikut: (lanjutan) and liabilities are as follows: (continued)

2021

Dampak Dikreditkan/

penyesuaian (dibebankan)

tarif pajak ke penghasilan Ditransfer

pada laporan Dikreditkan/ komprehensif ke/dari aset/

laba rugi/ (dibebankan) lain/ (liabilitas) pajak

Impact of ke Credited/ tangguhan/

adjustments due laba rugi/ (charged) Transfer to/

1 Januari/ to changes in Credited/ to other from deferred 31 Desember/

January tax rates to (charged) to comprehensive tax assets/ December

2021 profit or loss profit or loss income (liabilities) 2021

Aset pajak tangguhan Deferred tax assets

Liabilitas imbalan kerja 767,835 399 4,698 (37) (759,927) 12,968 Employee benefits liabilities

Bonus 121,252 2,452 (5,253) - (104,595) 13,856 Bonus

Cadangan kerugian

kredit ekspektasian Allowance for ECL

piutang usaha 4,238 421 306 - - 4,965 of trade receivables

Cadangan kerugian

penurunan nilai Allowance for decline in value

persediaan dan of inventories and

persediaan usang 3,307 2 1 - (3,292) 18 inventory obsolences

Aset tetap (29,493) 177 (104) - 16,956 (12,464) Property, plant and equipment

Akumulasi rugi fiskal 15,753 - - - (15,753) - Accumulated tax losses

Liabilitas sewa 29,821 (174) 174 - (29,671) 150 Lease liabilities

Aset pajak tangguhan Deferred tax assets at

akhir tahun 912,713 3,277 (178) (37) (896,282) 19,493 the end of the year

2021

Dampak Dikreditkan/

penyesuaian (dibebankan)

tarif pajak ke penghasilan Ditransfer

pada laporan Dikreditkan/ komprehensif ke/dari aset/

laba rugi/ (dibebankan) lain/ (liabilitas) pajak

Impact of ke Credited/ tangguhan/

adjustments due laba rugi/ (charged) Transfer to/

1 Januari/ to changes in Credited/ to other from deferred 31 Desember/

January tax rates to (charged) to comprehensive tax assets/ December

2021 profit or loss profit or loss income (liabilities) 2021

Liabilitas pajak

tangguhan Deferred tax liabilities

Liabilitas imbalan kerja - 71,665 65,942 (117,879) 759,927 779,655 Employee benefits liabilities

Bonus - - 3,076 - 104,595 107,671 Bonus

Cadangan kerugian

penurunan nilai Allowance for decline in value

persediaan dan of inventories and

persediaan usang - 328 23,792 - 3,292 27,412 inventory obsolences

Aset tetap (31,477) (1,087,743) (1,355,695) 106,275 (728,506) (3,097,146) Property, plant and equipment

Aset keuangan dari Financial assets

konsesi jasa (913,722) 380,159 157,346 - 727,303 351,086 of service concession

Liabilitas sewa - (38) 25,469 - 29,671 55,102 Lease liabilities

Liabllitas pajak

tangguhan Deferred tax liabilities at

akhir tahun (945,199) (635,629) (1,080,070) (11,604) 896,282 (1,776,220) the end of the year

Beban

pajak tangguhan (632,352) (1,080,248) (11,641) - Deferred tax expense

682 Laporan Tahunan 2022 www.plnindonesiapower.co.id

PT PLN Indonesia Power