Page 277 - Annual Report 2022 - PLN Indonesia Power

P. 277

Analisis dan Pembahasan Manajemen

Management Discussion and Analysis

Tinjauan Kinerja Keuangan

Financial Performance Highlights

Liabilitas Jangka Panjang

Non-Current Liabilities

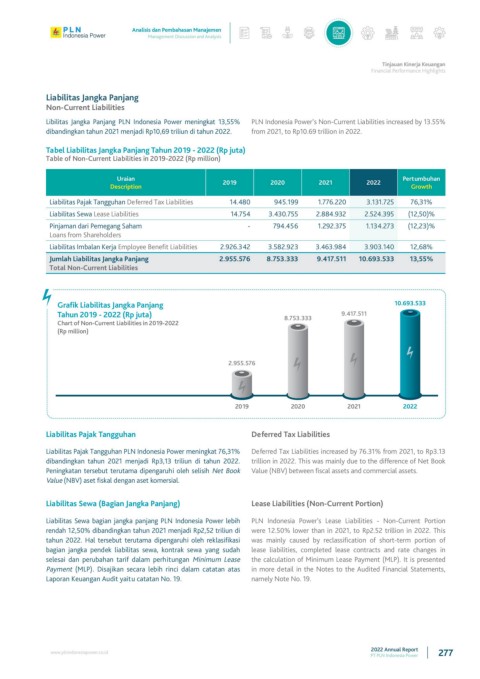

Libilitas Jangka Panjang PLN Indonesia Power meningkat 13,55% PLN Indonesia Power’s Non-Current Liabilities increased by 13.55%

dibandingkan tahun 2021 menjadi Rp10,69 triliun di tahun 2022. from 2021, to Rp10.69 trillion in 2022.

Tabel Liabilitas Jangka Panjang Tahun 2019 - 2022 (Rp juta)

Table of Non-Current Liabilities in 2019-2022 (Rp million)

Uraian Pertumbuhan

Description 2019 2020 2021 2022 Growth

Liabilitas Pajak Tangguhan Deferred Tax Liabilities 14.480 945.199 1.776.220 3.131.725 76,31%

Liabilitas Sewa Lease Liabilities 14.754 3.430.755 2.884.932 2.524.395 (12,50)%

Pinjaman dari Pemegang Saham - 794.456 1.292.375 1.134.273 (12,23)%

Loans from Shareholders

Liabilitas Imbalan Kerja Employee Benefit Liabilities 2.926.342 3.582.923 3.463.984 3.903.140 12,68%

Jumlah Liabilitas Jangka Panjang 2.955.576 8.753.333 9.417.511 10.693.533 13,55%

Total Non-Current Liabilities

Grafik Liabilitas Jangka Panjang 10.693.533

Tahun 2019 - 2022 (Rp juta) 8.753.333 9.417.511

Chart of Non-Current Liabilities in 2019-2022

(Rp million)

2.955.576

2019 2020 2021 2022

Liabilitas Pajak Tangguhan Deferred Tax Liabilities

Liabilitas Pajak Tangguhan PLN Indonesia Power meningkat 76,31% Deferred Tax Liabilities increased by 76.31% from 2021, to Rp3.13

dibandingkan tahun 2021 menjadi Rp3,13 triliun di tahun 2022. trillion in 2022. This was mainly due to the difference of Net Book

Peningkatan tersebut terutama dipengaruhi oleh selisih Net Book Value (NBV) between fiscal assets and commercial assets.

Value (NBV) aset fiskal dengan aset komersial.

Liabilitas Sewa (Bagian Jangka Panjang) Lease Liabilities (Non-Current Portion)

Liabilitas Sewa bagian jangka panjang PLN Indonesia Power lebih PLN Indonesia Power’s Lease Liabilities - Non-Current Portion

rendah 12,50% dibandingkan tahun 2021 menjadi Rp2,52 triliun di were 12.50% lower than in 2021, to Rp2.52 trillion in 2022. This

tahun 2022. Hal tersebut terutama dipengaruhi oleh reklasifikasi was mainly caused by reclassification of short-term portion of

bagian jangka pendek liabilitas sewa, kontrak sewa yang sudah lease liabilities, completed lease contracts and rate changes in

selesai dan perubahan tarif dalam perhitungan Minimum Lease the calculation of Minimum Lease Payment (MLP). It is presented

Payment (MLP). Disajikan secara lebih rinci dalam catatan atas in more detail in the Notes to the Audited Financial Statements,

Laporan Keuangan Audit yaitu catatan No. 19. namely Note No. 19.

2022 Annual Report

www.plnindonesiapower.co.id 277

PT PLN Indonesia Power