Page 273 - Annual Report 2022 - PLN Indonesia Power

P. 273

Analisis dan Pembahasan Manajemen

Management Discussion and Analysis

Tinjauan Kinerja Keuangan

Financial Performance Highlights

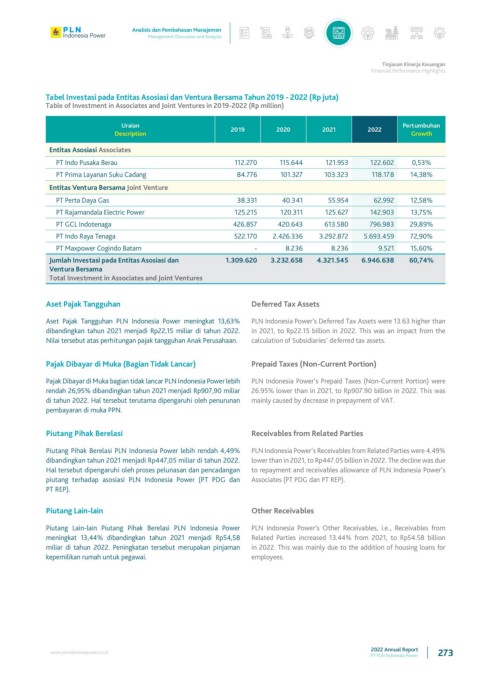

Tabel Investasi pada Entitas Asosiasi dan Ventura Bersama Tahun 2019 - 2022 (Rp juta)

Table of Investment in Associates and Joint Ventures in 2019-2022 (Rp million)

Uraian Pertumbuhan

Description 2019 2020 2021 2022 Growth

Entitas Asosiasi Associates

PT Indo Pusaka Berau 112.270 115.644 121.953 122.602 0,53%

PT Prima Layanan Suku Cadang 84.776 101.327 103.323 118.178 14,38%

Entitas Ventura Bersama Joint Venture

PT Perta Daya Gas 38.331 40.341 55.954 62.992 12,58%

PT Rajamandala Electric Power 125.215 120.311 125.627 142.903 13,75%

PT GCL Indotenaga 426.857 420.643 613.580 796.983 29,89%

PT Indo Raya Tenaga 522.170 2.426.336 3.292.872 5.693.459 72,90%

PT Maxpower Cogindo Batam - 8.236 8.236 9.521 15,60%

Jumlah Investasi pada Entitas Asosiasi dan 1.309.620 3.232.658 4.321.545 6.946.638 60,74%

Ventura Bersama

Total Investment in Associates and Joint Ventures

Aset Pajak Tangguhan Deferred Tax Assets

Aset Pajak Tangguhan PLN Indonesia Power meningkat 13,63% PLN Indonesia Power’s Deferred Tax Assets were 13.63 higher than

dibandingkan tahun 2021 menjadi Rp22,15 miliar di tahun 2022. in 2021, to Rp22.15 billion in 2022. This was an impact from the

Nilai tersebut atas perhitungan pajak tangguhan Anak Perusahaan. calculation of Subsidiaries’ deferred tax assets.

Pajak Dibayar di Muka (Bagian Tidak Lancar) Prepaid Taxes (Non-Current Portion)

Pajak Dibayar di Muka bagian tidak lancar PLN Indonesia Power lebih PLN Indonesia Power’s Prepaid Taxes (Non-Current Portion) were

rendah 26,95% dibandingkan tahun 2021 menjadi Rp907,90 miliar 26.95% lower than in 2021, to Rp907.90 billion in 2022. This was

di tahun 2022. Hal tersebut terutama dipengaruhi oleh penurunan mainly caused by decrease in prepayment of VAT.

pembayaran di muka PPN.

Piutang Pihak Berelasi Receivables from Related Parties

Piutang Pihak Berelasi PLN Indonesia Power lebih rendah 4,49% PLN Indonesia Power’s Receivables from Related Parties were 4.49%

dibandingkan tahun 2021 menjadi Rp447,05 miliar di tahun 2022. lower than in 2021, to Rp447.05 billion in 2022. The decline was due

Hal tersebut dipengaruhi oleh proses pelunasan dan pencadangan to repayment and receivables allowance of PLN Indonesia Power’s

piutang terhadap asosiasi PLN Indonesia Power (PT PDG dan Associates (PT PDG dan PT REP).

PT REP).

Piutang Lain-lain Other Receivables

Piutang Lain-lain Piutang Pihak Berelasi PLN Indonesia Power PLN Indonesia Power’s Other Receivables, i.e., Receivables from

meningkat 13,44% dibandingkan tahun 2021 menjadi Rp54,58 Related Parties increased 13.44% from 2021, to Rp54.58 billion

miliar di tahun 2022. Peningkatan tersebut merupakan pinjaman in 2022. This was mainly due to the addition of housing loans for

kepemilikan rumah untuk pegawai. employees.

2022 Annual Report

www.plnindonesiapower.co.id 273

PT PLN Indonesia Power