Page 280 - Annual Report 2022 - PLN Indonesia Power

P. 280

Powering Sustainable

and Prosperous Future

Tinjauan Kinerja Keuangan

Financial Performance Highlights

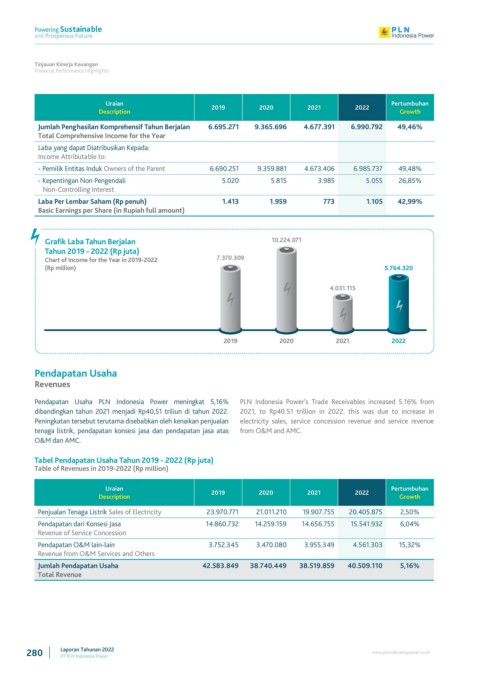

Uraian Pertumbuhan

Description 2019 2020 2021 2022 Growth

Jumlah Penghasilan Komprehensif Tahun Berjalan 6.695.271 9.365.696 4.677.391 6.990.792 49,46%

Total Comprehensive Income for the Year

Laba yang dapat Diatribusikan Kepada:

Income Attributable to:

- Pemilik Entitas Induk Owners of the Parent 6.690.251 9.359.881 4.673.406 6.985.737 49,48%

- Kepentingan Non Pengendali 5.020 5.815 3.985 5.055 26,85%

Non-Controlling Interest

Laba Per Lembar Saham (Rp penuh) 1.413 1.959 773 1.105 42,99%

Basic Earnings per Share (in Rupiah full amount)

Grafik Laba Tahun Berjalan 10.224.071

Tahun 2019 - 2022 (Rp juta)

Chart of Income for the Year in 2019-2022 7.370.309

(Rp million) 5.764.320

4.031.115

2019 2020 2021 2022

Pendapatan Usaha

Revenues

Pendapatan Usaha PLN Indonesia Power meningkat 5,16% PLN Indonesia Power’s Trade Receivables increased 5.16% from

dibandingkan tahun 2021 menjadi Rp40,51 triliun di tahun 2022. 2021, to Rp40.51 trillion in 2022. this was due to increase in

Peningkatan tersebut terutama disebabkan oleh kenaikan penjualan electricity sales, service concession revenue and service revenue

tenaga listrik, pendapatan konsesi jasa dan pendapatan jasa atas from O&M and AMC.

O&M dan AMC.

Tabel Pendapatan Usaha Tahun 2019 - 2022 (Rp juta)

Table of Revenues in 2019-2022 (Rp million)

Uraian Pertumbuhan

Description 2019 2020 2021 2022 Growth

Penjualan Tenaga Listrik Sales of Electricity 23.970.771 21.011.210 19.907.755 20.405.875 2,50%

Pendapatan dari Konsesi Jasa 14.860.732 14.259.159 14.656.755 15.541.932 6,04%

Revenue of Service Concession

Pendapatan O&M lain-lain 3.752.345 3.470.080 3.955.349 4.561.303 15,32%

Revenue from O&M Services and Others

Jumlah Pendapatan Usaha 42.583.849 38.740.449 38.519.859 40.509.110 5,16%

Total Revenue

280 Laporan Tahunan 2022 www.plnindonesiapower.co.id

PT PLN Indonesia Power