Page 644 - Annual Report 2022 - PLN Indonesia Power

P. 644

Powering Sustainable

and Prosperous Future

PT INDONESIA POWER DAN ENTITAS ANAKNYA/AND ITS SUBSIDIARIES

Lampiran 5/45 Schedule

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE CONSOLIDATED

KONSOLIDASIAN FINANCIAL STATEMENTS

31 DESEMBER 2022 DAN 2021 31 DECEMBER 2022 AND 2021

(Dinyatakan dalam jutaan Rupiah, kecuali dinyatakan lain) (Expressed in millions of Rupiah, unless otherwise stated)

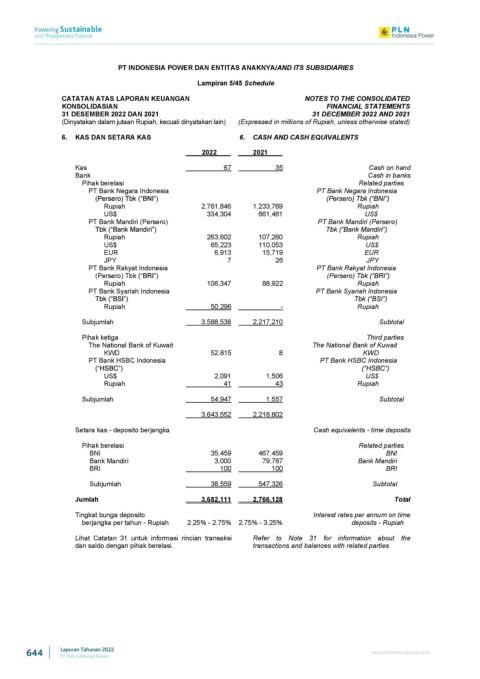

6. KAS DAN SETARA KAS 6. CASH AND CASH EQUIVALENTS

2022 2021

Kas 67 35 Cash on hand

Bank Cash in banks

Pihak berelasi Related parties

PT Bank Negara Indonesia PT Bank Negara Indonesia

Rupiah 2,761,846 1,233,769 Rupiah

US$ 334,304 661,461 US$

PT Bank Mandiri (Persero) PT Bank Mandiri (Persero)

Rupiah 263,602 107,260 Rupiah

US$ 65,223 110,053 US$

EUR 6,913 15,719 EUR

JPY 7 26 JPY

PT Bank Rakyat Indonesia PT Bank Rakyat Indonesia

(Persero) Tbk (Persero)

Rupiah 106,347 88,922 Rupiah

PT Bank Syariah Indonesia PT Bank Syariah Indonesia

Rupiah 50,296 - Rupiah

Subjumlah 3,588,538 2,217,210 Subtotal

Pihak ketiga Third parties

The National Bank of Kuwait The National Bank of Kuwait

KWD 52,815 8 KWD

PT Bank HSBC Indonesia PT Bank HSBC Indonesia

US$ 2,091 1,506 US$

Rupiah 41 43 Rupiah

Subjumlah 54,947 1,557 Subtotal

3,643,552 2,218,802

Setara kas - deposito berjangka Cash equivalents - time deposits

Pihak berelasi Related parties

BNI 35,459 467,459 BNI

Bank Mandiri 3,000 79,767 Bank Mandiri

BRI 100 100 BRI

Subjumlah 38,559 547,326 Subtotal

Jumlah 3,682,111 2,766,128 Total

Tingkat bunga deposito Interest rates per annum on time

berjangka per tahun - Rupiah 2.25% - 2.75% 2.75% - 3.25% deposits - Rupiah

Lihat Catatan 31 untuk informasi rincian transaksi Refer to Note 31 for information about the

dan saldo dengan pihak berelasi. transactions and balances with related parties

644 Laporan Tahunan 2022 www.plnindonesiapower.co.id

PT PLN Indonesia Power