Page 297 - Annual Report 2022 - PLN Indonesia Power

P. 297

Analisis dan Pembahasan Manajemen

Management Discussion and Analysis

Kontribusi kepada Negara

Contribution to the Country

Setoran pajak merupakan perwujudan dari kewajiban kenegaraan Tax payment is the responsibility and participation of taxpayers to

dan peran serta wajib pajak untuk secara langsung dan bersama- directly and jointly perform their tax obligation for financing the

sama melaksanakan kewajiban perpajakan untuk pembiayaan country and supporting the national development.

negara dan pembangunan nasional.

Selama tahun 2022 PLN Indonesia Power tidak terdapat In 2022, PLN Indonesia Power always made timely payment of tax

keterlambatan pembayaran kewajiban pajak, baik PPh Karyawan, obligations which include Employee Income Tax, Corporate Income

PPh Badan, PPN Masa dan PBB. Selain itu juga tidak terdapat Tax, Periodic VAT, and Land and Building Tax. The company also

keterlambatan penyampaian dokumen kewajiban perpajakan Surat punctually submitted tax documents such as annual and monthly

Pemberitahuan (SPT) tahunan dan bulanan, serta tidak terdapat Tax Returns as well as other obligatory documents to the regulator.

keterlambatan penyampaian dokumen kewajiban pada lembaga

regulator.

Setoran pajak pada tahun 2022 adalah sebesar Rp1,87 triliun The tax payment in 2022 was recorded at Rp1.87 trillion, which

meningkat 27,20% dibandingkan tahun 2021. Peningkatan improved 27.20% from 2021. This was due to a change in tax rate as

tersebut disebabkan oleh perubahan tarif pajak yaitu melalui stipulated in Law No. 7 of 2011 on Harmonization of Tax Regulations

Undang-Undang No. 7 Tahun 2021 tentang Harmonisasi Peraturan in which the Government gradually increases the VAT, to 11%

Perpajakan (UU HPP), Pemerintah menaikkan tarif PPN secara starting from April 2022, as well as the increase in expenses in 2022.

bertahap, yakni 11% mulai April tahun 2022 dan terdapat kenaikan

Beban pada Tahun 2022.

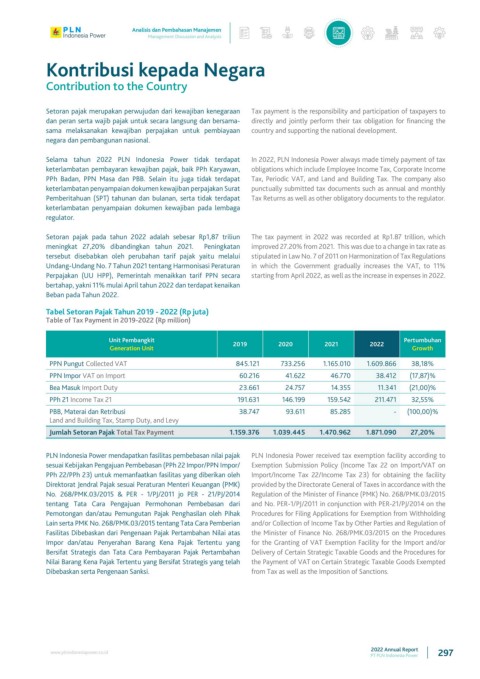

Tabel Setoran Pajak Tahun 2019 - 2022 (Rp juta)

Table of Tax Payment in 2019-2022 (Rp million)

Unit Pembangkit 2019 2020 2021 2022 Pertumbuhan

Generation Unit Growth

PPN Pungut Collected VAT 845.121 733.256 1.165.010 1.609.866 38,18%

PPN Impor VAT on Import 60.216 41.622 46.770 38.412 (17,87)%

Bea Masuk Import Duty 23.661 24.757 14.355 11.341 (21,00)%

PPh 21 Income Tax 21 191.631 146.199 159.542 211.471 32,55%

PBB, Materai dan Retribusi 38.747 93.611 85.285 - (100,00)%

Land and Building Tax, Stamp Duty, and Levy

Jumlah Setoran Pajak Total Tax Payment 1.159.376 1.039.445 1.470.962 1.871.090 27,20%

PLN Indonesia Power mendapatkan fasilitas pembebasan nilai pajak PLN Indonesia Power received tax exemption facility according to

sesuai Kebijakan Pengajuan Pembebasan (PPh 22 Impor/PPN Impor/ Exemption Submission Policy (Income Tax 22 on Import/VAT on

PPh 22/PPh 23) untuk memanfaatkan fasilitas yang diberikan oleh Import/Income Tax 22/Income Tax 23) for obtaining the facility

Direktorat Jendral Pajak sesuai Peraturan Menteri Keuangan (PMK) provided by the Directorate General of Taxes in accordance with the

No. 268/PMK.03/2015 & PER - 1/PJ/2011 jo PER - 21/PJ/2014 Regulation of the Minister of Finance (PMK) No. 268/PMK.03/2015

tentang Tata Cara Pengajuan Permohonan Pembebasan dari and No. PER-1/PJ/2011 in conjunction with PER-21/PJ/2014 on the

Pemotongan dan/atau Pemungutan Pajak Penghasilan oleh Pihak Procedures for Filing Applications for Exemption from Withholding

Lain serta PMK No. 268/PMK.03/2015 tentang Tata Cara Pemberian and/or Collection of Income Tax by Other Parties and Regulation of

Fasilitas Dibebaskan dari Pengenaan Pajak Pertambahan Nilai atas the Minister of Finance No. 268/PMK.03/2015 on the Procedures

Impor dan/atau Penyerahan Barang Kena Pajak Tertentu yang for the Granting of VAT Exemption Facility for the Import and/or

Bersifat Strategis dan Tata Cara Pembayaran Pajak Pertambahan Delivery of Certain Strategic Taxable Goods and the Procedures for

Nilai Barang Kena Pajak Tertentu yang Bersifat Strategis yang telah the Payment of VAT on Certain Strategic Taxable Goods Exempted

Dibebaskan serta Pengenaan Sanksi. from Tax as well as the Imposition of Sanctions.

2022 Annual Report

www.plnindonesiapower.co.id 297

PT PLN Indonesia Power