Page 68 - Laporan Statistik 2022 - PLN Indonesia Power

P. 68

Statistic Report

PT PLN Indonesia Power 2022

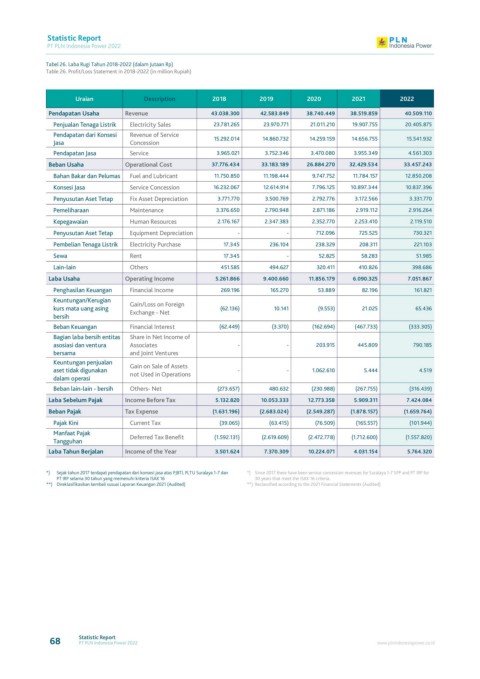

Tabel 26. Laba Rugi Tahun 2018-2022 (dalam Jutaan Rp)

Table 26. Profit/Loss Statement in 2018-2022 (in million Rupiah)

Uraian Description 2018 2019 2020 2021 2022

Pendapatan Usaha revenue 43.038.300 42.583.849 38.740.449 38.519.859 40.509.110

Penjualan Tenaga Listrik Electricity Sales 23.781.265 23.970.771 21.011.210 19.907.755 20.405.875

Pendapatan dari Konsesi Revenue of Service 15.292.014 14.860.732 14.259.159 14.656.755 15.541.932

Jasa Concession

Pendapatan Jasa Service 3.965.021 3.752.346 3.470.080 3.955.349 4.561.303

Beban Usaha Operational Cost 37.776.434 33.183.189 26.884.270 32.429.534 33.457.243

Bahan Bakar dan Pelumas Fuel and Lubricant 11.750.850 11.198.444 9.747.752 11.784.157 12.850.208

Konsesi Jasa Service Concession 16.232.067 12.614.914 7.796.125 10.897.344 10.837.396

Penyusutan Aset Tetap Fix Asset Depreciation 3.771.770 3.500.769 2.792.776 3.172.566 3.331.770

Pemeliharaan Maintenance 3.376.650 2.790.948 2.871.186 2.919.112 2.916.264

Kepegawaian Human Resources 2.176.167 2.347.383 2.352.770 2.253.410 2.119.510

Penyusutan Aset Tetap Equipment Depreciation - - 712.096 725.525 730.321

Pembelian Tenaga Listrik Electricity Purchase 17.345 236.104 238.329 208.311 221.103

Sewa Rent 17.345 - 52.825 58.283 51.985

Lain-lain Others 451.585 494.627 320.411 410.826 398.686

Laba Usaha Operating income 5.261.866 9.400.660 11.856.179 6.090.325 7.051.867

Penghasilan Keuangan Financial Income 269.196 165.270 53.889 82.196 161.821

Keuntungan/Kerugian Gain/Loss on Foreign

kurs mata uang asing Exchange - Net (62.136) 10.141 (9.553) 21.025 65.436

bersih

Beban Keuangan Financial Interest (62.449) (3.370) (162.694) (467.733) (333.305)

Bagian laba bersih entitas Share in Net Income of

asosiasi dan ventura Associates - - 203.915 445.809 790.185

bersama and Joint Ventures

Keuntungan penjualan Gain on Sale of Assets

aset tidak digunakan not Used in Operations - - 1.062.610 5.444 4.519

dalam operasi

Beban lain-lain - bersih Others- Net (273.657) 480.632 (230.988) (267.755) (316.439)

Laba sebelum Pajak income Before Tax 5.132.820 10.053.333 12.773.358 5.909.311 7.424.084

Beban Pajak Tax expense (1.631.196) (2.683.024) (2.549.287) (1.878.157) (1.659.764)

Pajak Kini Current Tax (39.065) (63.415) (76.509) (165.557) (101.944)

Manfaat Pajak Deferred Tax Benefit (1.592.131) (2.619.609) (2.472.778) (1.712.600) (1.557.820)

Tangguhan

Laba Tahun Berjalan income of the Year 3.501.624 7.370.309 10.224.071 4.031.154 5.764.320

*) Sejak tahun 2017 terdapat pendapatan dari konsesi jasa atas PJBTL PLTU Suralaya 1-7 dan *) Since 2017 there have been service concession revenues for Suralaya 1-7 SPP and PT IRP for

PT IRP selama 30 tahun yang memenuhi kriteria ISAK 16 30 years that meet the ISAK 16 criteria.

**) Direklasifikasikan kembali susuai Laporan Keuangan 2021 (Audited) **) Reclassified according to the 2021 Financial Statements (Audited)

68 Statistic Report www.plnindonesiapower.co.id

PT PLN Indonesia Power 2022